Price to Book Value

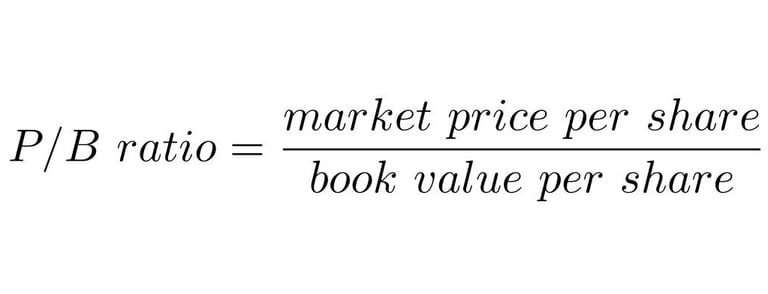

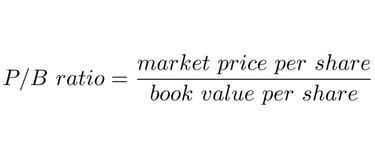

Many investors use the price-to-book ratio (P/B ratio) to compare a firm's market capitalization to its book value and locate undervalued companies. This ratio is calculated by dividing the company's current stock price per share by its book value per share (BVPS).

The P/B ratio reflects the value that market participants attach to a company's equity relative to the book value of its equity. Many investors use the P/B ratio to find undervalued stocks. By purchasing an undervalued stock, they hope to be rewarded when the market realizes the stock is undervalued and returns its price to where it should be—according to the investor's analysis. Some investors believe that the P/B ratio is a forward-looking metric that reflects a company's future cash flows; however, when you look at the information used to calculate the P/B ratio, the factors used are the price investors are willing to pay currently, the number of shares issued by a company, and values from a balance sheet that reflect data from the past. Thus, the ratio isn't forward-looking and doesn't predict or indicate future cash flows.